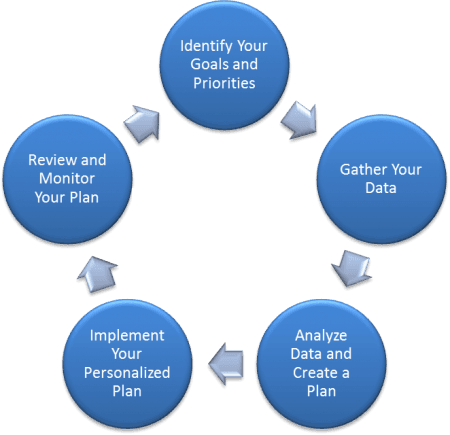

Our Process

Identify Your Goals and Priorities

We begin this stage during our initial meeting where we get to know one another. We focus on what your specific needs are and what goals and priorities you have. We complete a comprehensive risk questionnaire, which is essential to understanding your investment mind-set.

Gather Your Data

We gather any necessary documents, policies and statements. Together with us, you will define your personal and financial goals, including timeframes.

Analyze Data and Create a Plan

The primary objective of this stage is to help develop an effective, long-term investment strategy that is custom tailored to the unique needs of each client. We then develop a comprehensive plan that outlines the strategy we recommend to help achieve your goals.

Implement Your Personalized Plan

The primary objective of this phase is to help successfully implement your investment strategy. By means of constant communication and a highly skilled staff, we strive to make this process quick and easy for you.

Review and Monitor Your Plan

We monitor our client’s accounts on a regular basis to help ensure they are still performing in a way that meets your intentions. Communication with you is a top priority. We explain and answer questions about our reporting methods, and stay in touch with you to keep you informed. When we discover that your circumstances have changed, or that shifting global markets require a different investing approach, we communicate to you our recommendations for the appropriate adjustments.

Schedule Your Appointment with

Daniel Altwegg

Today!

Phone (612) 327-9249

Disclaimer

Out of the Box Financial (OTB) is a financial services firm helping clients prepare for retirement and business succession through the use of insurance and annuities. OTB does not offer investment products or advice, and is not affiliated with the Social Security Administration or any other governmental agency. Insurance and annuity returns are backed by the financial strength and claims-paying ability of the issuing company. Investing involves risks, including possible loss of principal. OTB is not a registered broker/dealer. This website may contain concepts that have legal, accounting and tax implications. It is not intended to provide legal, accounting, tax or investment advice. By contacting our company, you may be offered information regarding insurance and fixed index annuity products.